The “E”s of eClosing

About the author: Guy has been a commissioned notary for more than 5 years. He also runs one of the most established Facebook groups for Remote Online Notarization with over 7000 members nationwide.

The COVID-19 pandemic and it’s resultant social distancing guidelines emphasize the need for a safer and more convenient alternative to in-person notarizations. Remote online notarizations (RON’s) meet these needs by providing an alternative to physically travelling and appearing before a notary. Safety and convenience may be the most obvious advantages of RON’s, but security and accurate recordkeeping are also essential elements of the RON process. This is especially true in the case of an eClosing.

What is an eClosing?

If you have ever purchased a house, you know that the single, most important event in the homebuying process is “The Closing”. During a closing, the buyers, sellers, and mortgage lenders meet to complete all of the paperwork required in a home sale. This paperwork includes recording the payment to the seller, and the transfer of the deed and mortgage to the buyer.

An eClosing allows some or all of these important documents to be completed electronically. In order to complete this process electronically, the mortgage lending industry created specialized document formats. These ensure accurate and secure record keeping of all the electronic closing documents. The most important of these documents is the eNote.

What is an eNote?

Almost any significant loan, but especially a mortgage, requires a “promissory note”. The promissory note is a “promise” from the borrower to the lender accepting the terms and amount of the loan. An eNote is a specialized promissory note used for eClosings. eNotes are designed for secure record keeping and are a specialized, secure file type. This file type, known as MISMO XML SmartDoc eNote, provides tamper-proof security to the electronic promissory note.

This specialized file format protects both the lender and buyer from any unauthorized changes to the promissory note. This becomes especially important, and a bit more complicated, once the eNote enters the “secondary market”.

The eVault & eRegistry: Keeping track of the eNote

The primary mortgage market is where the homebuyer shops for and selects a mortgage lender. In the secondary market, the initial mortgage lender can sell your mortgage to other financial institutions. eNote’s allow for a more secure transaction, especially in this secondary market.

As opposed to other electronic file formats, like the PDF, the eNote file format is signed and sealed in real-time and provides tamper proofing. What this means to the borrower is that the terms of their loan are safe from change when being bought and sold on the secondary market.

To ensure proper tracking of eNote transactions, the mortgage industry has also developed secure storage and recordkeeping software. These are known as the eVault and the eRegistry.

The eRegistry is officially known as the Mortgage Electronic Registration System (MERS).

The eRegistry houses all of the transactions related to the eNote. If your eNote is sold by the original mortgage lender, this transactions is recorded in the eRegistry. This allows the original eNote to be tracked between lenders and prevents lenders from electronically altering the terms of the eNote.

The eVault, also registered with MERS, is where the primary data of the eNote is stored. Think of the eVault as a secure, electronic filing cabinet where your eNote is located.

eRecording

The final “E” we’ll be discussing is one that takes place from the beginning to end of your eClosing. E-recording is the process by which all of your electronic documents, signatures, and notary seals are encrypted and sent to the appropriate parties for official documentation and storage. Unlike the eNote, which is a specific file type used for mortgage promissory notes, there are a number of software programs able to electronically record your eClosing. Due to slow adoption of technology, not all county offices are able to securely e-record. Make sure to check with the county where your closing will be filed to make sure that an eClosing is an option for you.

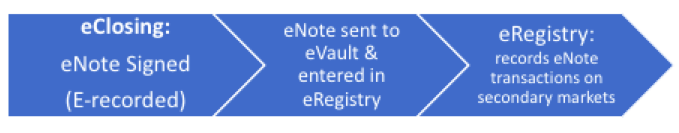

While the process may sounds confusing, the below illustration simplifies the process:

eClosings: The Future of Closings?

The Uniform Electronic Transactions Act of 1999 and the US Electronic Signatures in Global and National Commerce Act of 2000 both allowed for the use of eNotes in all 50 states. Despite these laws, the growth in the number of eClosings was slow. As with so many things, the COVID-19 pandemic altered this trend.

Prior to 2020, there was an average of 10,000 new eNotes registered monthly. In August of 2020 alone, over 45,000 eNotes were registered. eNotes are now accepted by government sponsored lenders, such as Freddie Mac and Fannie May. As more individuals take advantage of these convenient options for mortgage closings, it’s likely that there will be less and less demand for traditional, in-person mortgage closings.

As with any remote online notarizations, it’s important that you do your homework. Make sure your specific transaction is able to be completed remotely in your state and that you have the necessary technology to complete the remote notarization. Check with your lender to see if they accommodate eClosings.

Many people may still consider eClosings a new technology. They may have security concerns about completing their closing electronically. If you have concerns about excessive in-person contact during the COVID-19 pandemic, hopefully this discussion has provided you the knowledge and confidence to consider an eClosing.